IDBI is one of the most popular banks operating in the public sector in India. They offer a wide range when it comes to banking products in the current account, and savings account to MSME loans and retail. Along with that, there are more services, including fund transfer, net banking, IDBI bank balance, mini statement, etc.

The bank offers related services to corporate and retail banking to stay in a market where the competition in India. However for using the services and any other facilities, the person must have the login details and registration regarding the net banking,

How to Register For IDBI Net Banking?

In order to activate internet banking, there are a few easy steps that you need to take. Net banking allows the person to get all account and transaction-related information. There are information like account wherever you want to know, Demat account information, online instructions as well as requests. It includes all information such as online payment services including payments, online shopping, bill payment, etc.

Offline:

To activate the IDBI bank net banking, you have first to get the registration form that is available on the IDBI’s website. There will be questions asked, and you have to submit the information. You have to submit it to the nearest office of the IDBI bank or the branch. Your request will be get approved, and then you can do the online internet banking password.

Online:

The customers of IDBI Bank can apply for internet banking services online if they are having a registered mobile number and a debit card.

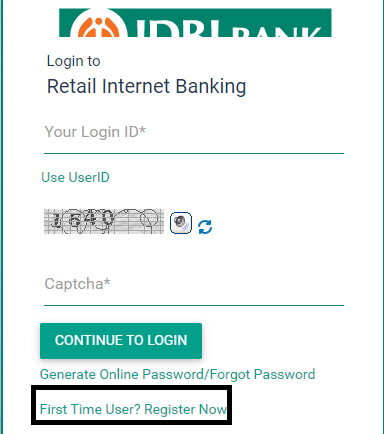

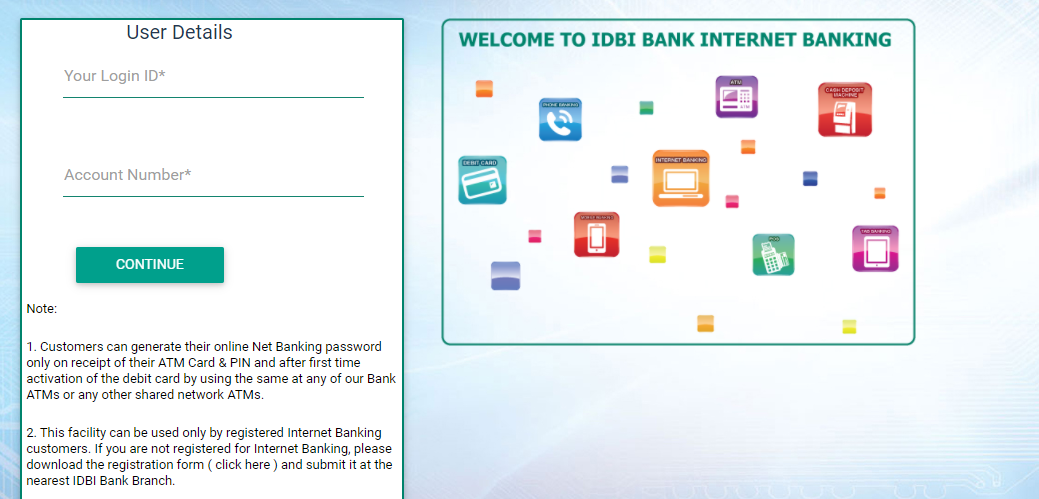

- First, visit the official internet banking website of IDBI Bank. You can visit by clicking here.

- After that, click on the login button.

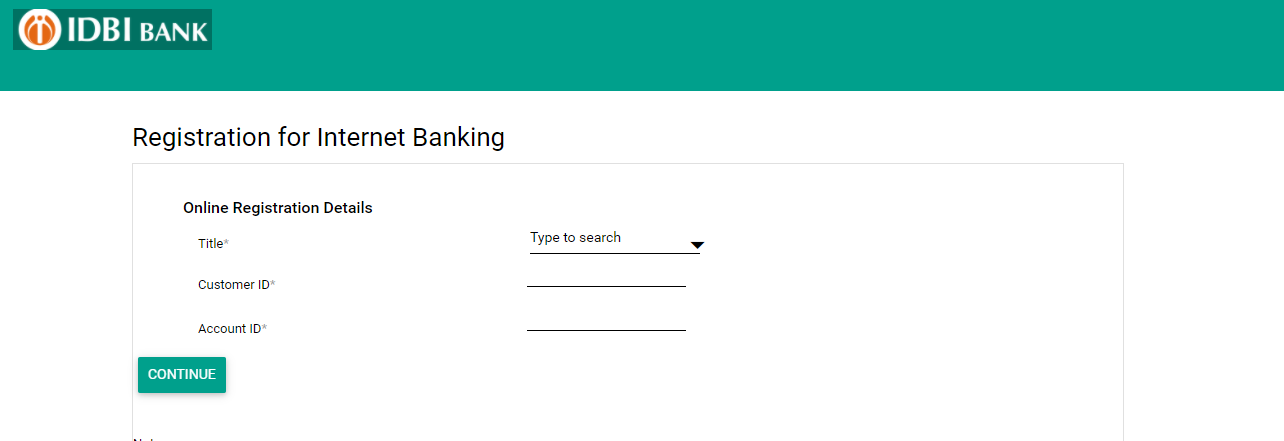

- From the login page, click on the new registration button.

- A popup window will appear. Just accept the terms and conditions.

- After that, one needs to fill in the registration form with the required details.

- Complete the verification using a debit card and the registered mobile number.

- Enter the OTP.

- Set up the user id and password.

- That’s it.

How to Login and Change the Password?

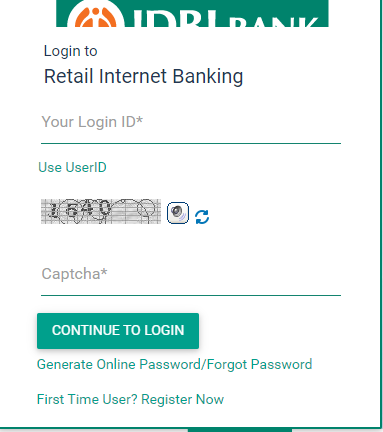

Login to your account and follow the easy process:

- The first thing you need to do is to get the website’s login page. You will get the login to continue option by clicking the left side of the page where you need to select the personal. Once you are done, submit the ID, password and you are ready to log in.

- In case your password is incorrect, or you forget it, you will get the signed on password where you are going to fill the password and enter the password you want, again you are going to do the entering the password to confirm. To change the password, you are going to follow the exact process and sign-on password.

- This is how the password will change, and you need to click the banking services available on the page

- Once you are done, you are available to choose the options as per you like. If you are going to choose the deposit account, then click on it and select. To confirm click on the go button. If not, then choose the loan accounts and all account options.

- After that, you can select the bills so you can view the pay regarding details. There is one more step you are going to get here is clicking on the card to card, so you can do the transactions to any card including VISA and Debit in India.

- Click on the option Transfer in order to send the money to any other account from yours

- Now click the GOI bond and then Demat where you need to select the DP option and submit it

- You get the easy fill option where you can do the recharge on phones, here you need to enter the number which should be registered

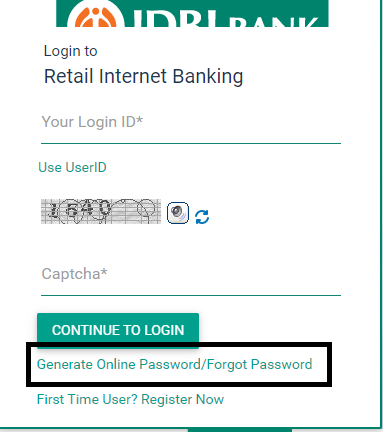

How to Reset IDBI Net Banking Password?

One can quickly reset the internet banking password of IDBI Bank. You only have to follow the steps that we have given below.

- First, visit the official internet banking website of IDBI Bank. You can visit by clicking here.

- After that, click on the login button.

- From the login page, click on the forgot password button.

- A new page will get open.

- Just enter the account number and the user id.

- Click on the continue button.

- You now have to complete the identity verification using a debit card and mobile number.

- Complete the verification and set up the new login password.

- That’s it.

What are the Important Guidelines that you need to know?

When you are requesting the password online, there are few things that you need to know. These are the crucial guidelines which must you know:

- Your Debit card and ATM card need to be activated

- Make sure that your number is registered and updated in the records of the bank

- Do not share any kind of sensitive information online or to anyone. This includes account details, Login, OTP, and debit card.

- The net banking of IDBI is not currently not applicable for NPS subscription, PFF subscription, online fixed deposits and options like PMJBY, PMSBY, GOI Bonds, ASBA like investments,

If your account gets blocked while the wrong typing password, you can simply request for new password. This process can be done online by the person himself.

What are the Features that the IDBI Net Banking Offers?

Customers of bank-related on to Retail as well as corporations have access on several features which is offering by the bank once they activate their accounts, it includes :

Account Information :

Save your time and get the information whenever you need without hassling more. The bank offers the account information of yours anywhere without worrying about the location. Here is the kind of bank account information that you can get :

- Loans EMI

- Status of the cheque

- Statements of the customized bank

- Account request as well as status reports

- Tracking the transaction and historical data

Online Instructions:

There are several features which help the customers to get the online instructions, paying the bills, and doing other works. It includes:

- Mobile and OTH recharge

- Stop payment

- Cheque book

- Fixed and recurring deposit

Online Payments:

Well to solve one of the daily need and making it safe as well as hassle-free. The bank is offering features which make the online payments easy. The bank is partnered with different merchants as well as websites, including the E-commerce stores. It includes the online sharing trade portals, mutual funds sellers, etc

Demat Account Information:

- It includes information like:

- Billing information including all the charges which are applied

- Statements regarding the transaction

- Displays Demat scrip with scrip name, balance and ISIN code

Also, while registering and performing all other processes. It’s important for the account holder to read the information which is given. Along with that bank is offering a secure transaction and easy as well as hassle-free process.

Not just that the services and facilities have its range which covers all the need and important points so you can get whatever you are looking for without wasting time or anything. In case of doubts or query, the account holders also get the number on which they can contact the customer care when they need.

IDBI Bank Customer Care

The customers of IDBI bank can call on the toll-free number 1800 209 4324 for any queries or issues related to the IDBI internet banking services.

This service is free of cost. Moreover, the customer can talk to the phone banking officer regarding any issues. However, one needs to provide some information to validate the account holder.

Frequently asked questions

Who can avail of the IDBI internet banking facility?

Everyone who is having a bank account with IDBI bank can avail of the internet banking facility.

How to get logged in to the IDBI internet banking portal?

You need a login id and password for getting logged in to the internet banking portal. You can get the login id and password after completing the registration for internet banking.

Can I change the user id and password?

Yes, one can change the user id and password after getting logged in to the IDBI internet banking portal.

How to Reset the internet banking password?

It is a quick process. You can reset the net banking login password online using a debit card and mobile number linked with the bank account. However, we even have added a quick guide above for this.

How to get the registration form?

You can get the IDBI internet banking registration form online or by visiting the home branch.

Just ask for the net banking registration form to one of the bank executives.

Is it possible to make online net banking registration?

Yes, it is possible to make online net banking registration. The customer needs to have a valid registered mobile number and a debit card to complete the IDBI online banking registration process.

Furthermore, we even have added a quick guide for this above.

How to contact IDBI Bank customer service?

The customers of IDBI bank can call on the toll-free number 1800 209 4324 for any queries or issues related to the IDBI internet banking services.

Conclusion:

IDBI bank is one of the leading banks in India. It is best in providing personal and corporate banking services to the customers. Apart from personal and corporate banking services it also good in providing financial banking services to the customers. We do know that internet banking is currently a vast need for everyone and IDBI bank is all set to provide easy access to digital banking. In this post, we have mentioned the same details for the activation and login of IDBI bank net banking.