The Government has made it compulsory to link your identity proof of Aadhaar card with your bank account. For people who still don’t have Aadhaar, it is highly recommended to apply as it is used as proof of identity and residence. Check simple steps to Link Aadhaar with SBI Bank Account.

Today all banks also made it mandatory for their customers to link their Aadhaar with unique identification numbers with their respective SBI bank accounts. If not linked, you cannot able to do banking related transactions.

Today SBI provided multiple online options, enabling its customers to link their bank account with Aadhaar easily. Let me share in detail what online options simplify Aadhaar linking to the bank account task easier.

How to Link Aadhaar with SBI Bank Account Online?

To avail of this, register as an SBI internet banking user and have an active profile.

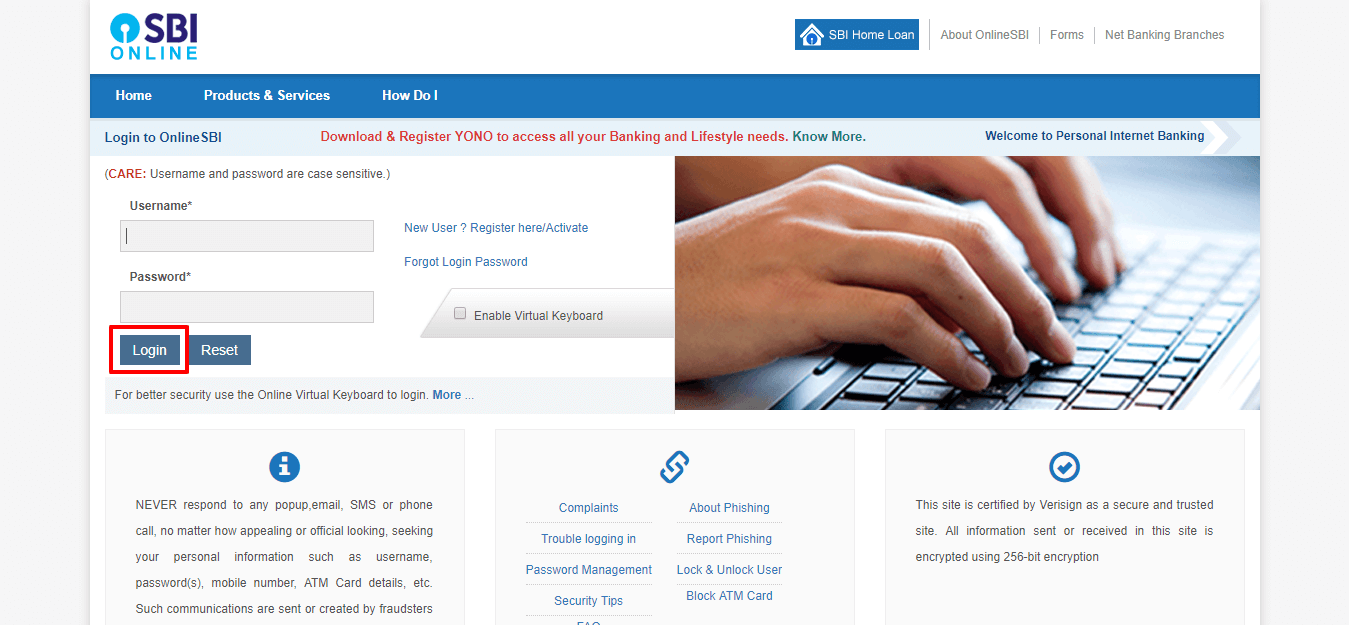

- Open the SBI portal onlinesbi.com.

- Login through Internet Banking.

- Go to the e-Services field.

- Click the “Update Aadhaar with Bank Accounts (CIF)” option.

- Enter your profile password and click on the submit button.

- From the drop-down menu, select your CIF number.

- Enter your Aadhaar number two times and click on the submit button.

- Your Aadhaar will be linked with your SBI bank account.

- You get a confirmation mail or SMS once it is linked successfully.

Online Method

- Open SBI official website.

- Choose the e-Services option.

- Click the “Update Aadhaar with Bank Accounts (CIF)” option.

- Enter your Aadhaar 12–digit number and press the confirm button.

- Carefully read terms & conditions, tick the disclaimer and click the submit button.

- You will get a confirmation message upon successful Aadhaar linking with your account.

ATM

- Go to an SBI ATM nearby your region.

- Swipe your SBI ATM debit card and enter your PIN.

- Choose “Service Registration” & click the “Aadhaar Registration” option.

- Select your account type (Savings/Checking/Current).

- Enter your Aadhaar number twice.

- Bank accepts your request and within 24 hours, your Aadhaar will be linked to your bank account.

Mobile App

- Download & Open SBI Anywhere Personal mobile app.

- Go to “Requests” & select the “Aadhaar Linking” option.

- Choose the CIF number from the list.

- Enter Aadhaar number twice to confirm.

- Read Terms & Conditions, tick the disclaimer and choose to submit button.

- You get a message of successfully processed requests.

- Click on the “OK” button to finish the process.

SMS Method

To avail of the SMS method, SBI users have to register their mobile number with the bank.

- Type message as UID<space><Aadhaar Number><Account Number>

- Send it to 567676.

- After the successful seeding of Aadhaar, you get a confirmation message.

How to Link Aadhaar with SBI Bank Account Offline?

We have added all the manual and online processes above to get the aadhar card linked with the SBI bank account. However, if one does not want to opt for the online option, then the customer can visit the SBI bank for getting their aadhar card linked with their bank account.

You can also follow the steps that we have added below.

- You need to visit the nearest branch of the State bank of India across your location. (Please make sure to carry the original or copy of a valid aadhar card)

- Talk to any of the bank executives and ask for the application form for linking aadhar.

- Fill in the given form with all the required information.

- Attach a self-attested copy of the aadhar card.

- Submit the particular application form to the bank executive.

- That’s it.

- You will receive an SMS on your bank registered mobile number once the linking process gets done.

How to Check Status of Aadhaar card linked to SBI Account?

- Visit Aadhaar Website uidai.gov.in

- Click on ‘Check Aadhaar & Bank Account Linking Status’

- Enter 12 digit Aadhaar number & security code.

- Enter OTP that has been sent to your mobile.

- After login, the website shows your Aadhaar is successfully linked or not.

Frequently asked questions

You must be having a question in your mind? Alright. We have decided to answer all the common questions in this section.

How can I link my aadhar card with SBI Bank?

You can link your aadhar card with the State bank of India by visiting the nearest SBI branch. However, do not forget to carry a self-attested copy of your aadhar card.

Furthermore, one can also check out the guide we have added above for this.

How can I link my aadhar card with the State bank of India Online?

There is nothing difficult in this process. You only need to have a valid aadhar card, mobile number (Linked with both an aadhar card and a bank account).

If you have these all, you can complete this process online at the OnlineSBI website. Furthermore, one can check out the detailed guide we have added above in this article.

How can I check the status?

You can check the status of your linking process at the official UIDAI (Unique Identification Authority of India).

Is it compulsory to link an aadhar card with the bank account?

Yes, it is compulsory to link an aadhar card with the bank account.

Within how much time the aadhar card gets linked with the SBI Bank account?

It will take a maximum of 24 hours for the bank to process the request. However, you will get an SMS once the process gets done.

What is Aadhar Seeding?

Aadhar seeding is a process to find out the duplicate aadhar card linked with various bank accounts. It is to ensure the security of the customers.

What if I do not get my aadhar card linked with the bank account?

According to the latest government and RBI rules, the customer will not able to use the banking services if the aadhar card does not get updated with the bank account. Therefore, the banking services will be stopped.

Conclusion

Here we come at the end. State Bank of India is one of the largest banks in the country. It has millions of customers’ bank accounts. However, this article is all related to linking an aadhar card with the SBI Bank account. In this article, we have added a piece of complete detailed information along with a process to link an aadhar card with an SBI bank account.

In case of any queries related to this article? Do let us know via the comments section.