The banking sector has improved so far in these years, and in upcoming years it will be most vast. Everything is now digital, and so that bank is coming with their digital banking services as well. Digital banking services bought the supreme convenience to the account holders of every bank. The use of internet banking not only saves their time but also the visits to the bank are less these days. In this post, we are talking about one of the most leading banks in India, the Yes bank. Yes bank serves millions of customers to satisfy the need for top quality and hassle-free banking services along with attractive interest rates. You can use Yes bank net banking services for a variety of services like transferring funds, payment of your digital things online, bill payments, DTH, and electricity payments via internet banking.

We know that Yes bank is one of the modern banks of India and It has more accounts of the businessmen. However, we are talking about the internet banking services of Yes bank and so before coming directly to the registration part, let me tell you some of the features of Yes bank’s internet banking service.

Features

I am dividing each section into parts. To make sure it is more understandable to you.

Financial Facilities:

- Standing Instructions – Yes bank is the only bank that allows the customer to set up standing instructions. This option is good for the salaried account where the funds automatically get transferred to their employee’s account at a specific interval.

- Fund Transfer – This is another comfortable option for the customers of Yes bank as they can no transfer the funds from one bank account to another using the Yes bank internet banking facility.

- IMPS Fund Transfer – IMPS money transfer is free of cost, and this facility is only available through Yes bank internet banking facility. You can instantly transfer the funds using your Yes bank account to any bank account.

- Open RD & FD- There is no need to visit the branch and waste your precious time in filling forms and submission to the branch for opening FD and RD. You can open your fixed deposit and recurring deposit account using Yes bank internet banking service.

- Online Bill Payment– You can do most of the bill payments online using Yes bank net banking.

- Credit Card Bill Payment – Credit card bill payments are now more accessible. There is no need to submit the cheque at the bank. The same payments can be transferred via internet banking.

- Mutual Funds Investment – You can also invest in mutual funds using net banking.

Informational Facilities:

- Check FD & RD Details – You can check your fixed deposit and recurring deposit account details through internet banking.

- Avail Account-Related Information – You can avail most of the account related information like the balance inquiry and other details of the transactions.

- Analyze Cheque Status – You can check out the cheque status of yours using internet banking.

- Information about Account Charges – You will have the information on charges if you do not have maintained the QAB balance.

- Investment Details – You will have the list and data of all the investment details you made.

Avail Service Requests

- You can use Yes bank internet banking for availing most of the service requests from home like the request for a new cheque book, debit card, etc.

- You can update your confidential information like number, email id, and pan card.

- You can request email statements.

- You can also request mobile banking services from internet banking.

Additional Services

- You can use the Yes pay now service for making bills more conventionally.

- You can make donations to different charities.

- Use your net banking or debit card to settle payments on various online e-commerce stores.

How to Register for YES Bank Net Banking?

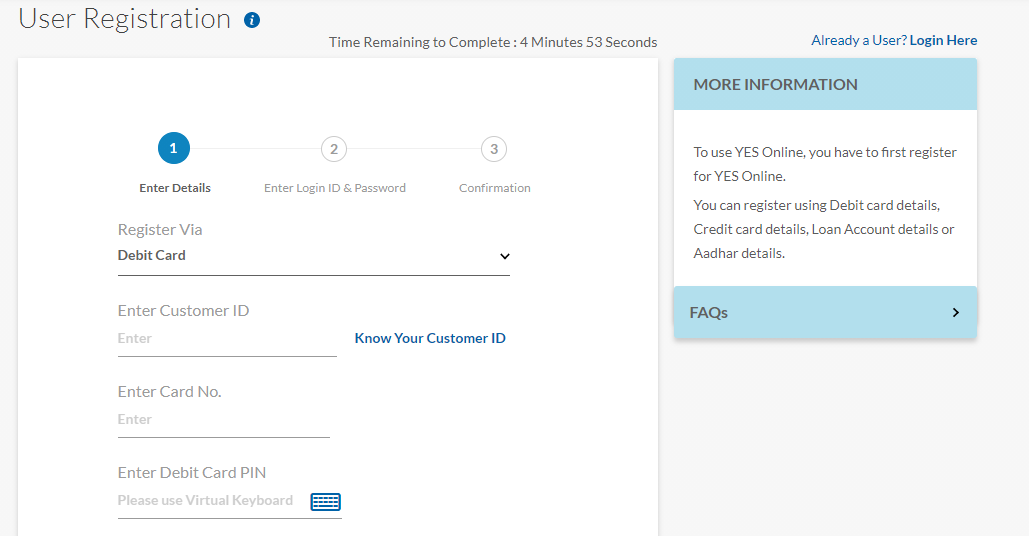

It is an easy five steps process for most of the customers. The only thing you require for the Yes bank internet banking registration is your debit card and your registered mobile number linked with your Yes bank account. You know that every new customer of Yes bank provided with a welcome kit that contains your debit card, pin, and the customer ID which is all you need for the internet banking activation of Yes bank. Let me show you using steps.

Steps:

- You need to visit the official website of Yes bank and then go through the login page.

- From there, click on new registration.

- A form will appear where you need to fill in the required information like the customer ID and debit card details.

- After that, you need to enter the OTP and pin for your ATM card.

- On the next screen, you need to set the password for your internet banking account.

- Once created, you are now ready to login into the Yes bank internet banking portal.

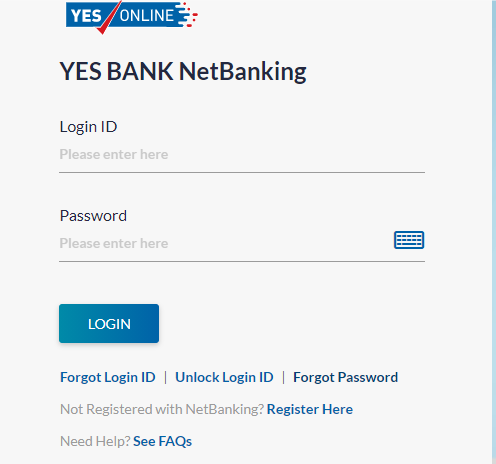

How to Login to the YES Bank internet banking portal?

So, now you have registered with Yes bank internet banking account. We know that you are a first time user of internet banking. Therefore, we are adding a login process as well for our readers.

Steps:

- Revisit the login page of Yes bank.

- Enter the customer ID and password on the screen.

- Click on submit.

- You will be redirected to the dashboard of the Yes bank internet banking portal.

- Do not forget to log out once your transaction is done.

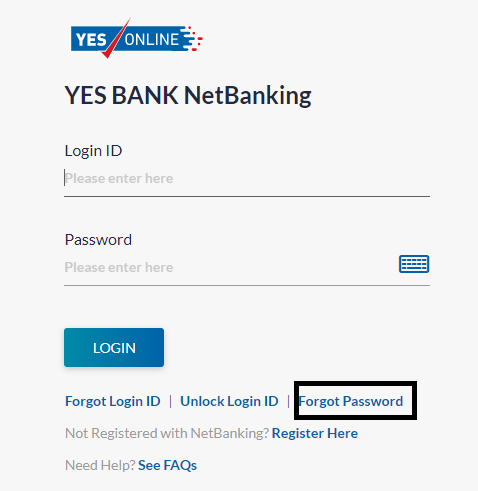

How to Reset YES Bank Login Password?

The customer can always reset the login password online with the help of their credit/debit cards. However, one needs to provide complete information to set up a new password online.

Furthermore, one can check out the steps we have added below.

- First, one needs to visit the YES Bank internet banking website.

- After that, one needs to go through the login page. (You can directly visit the login page by clicking here)

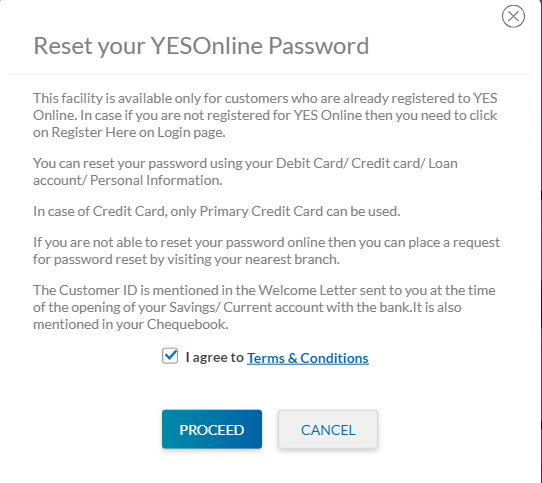

- From the login page, click on the “Forgot password” option.

- You now have to accept the terms and conditions popup message.

- On the next screen, you need to enter the user id and complete the verification using a credit or debit card.

- After the verification, one will be able to set up the new login password online.

How to Retrieve YES Bank Login ID Online?

There is no need to get worried. If one has forgotten the login id. The customer can always reset the login id using the online platform.

One can also follow the steps we have given below.

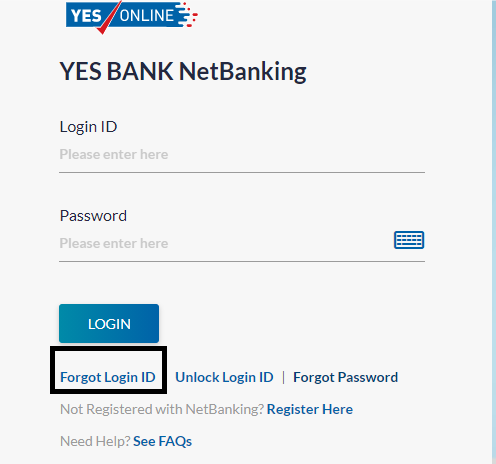

- First, one needs to visit the YES Bank internet banking website.

- After that, one needs to go through the login page. (You can directly visit the login page by clicking here)

- From the login page, click on the “Forgot login id” option.

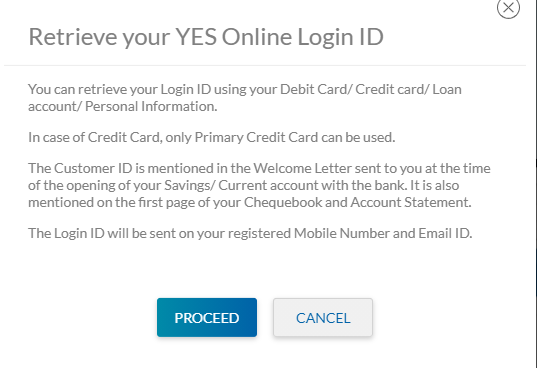

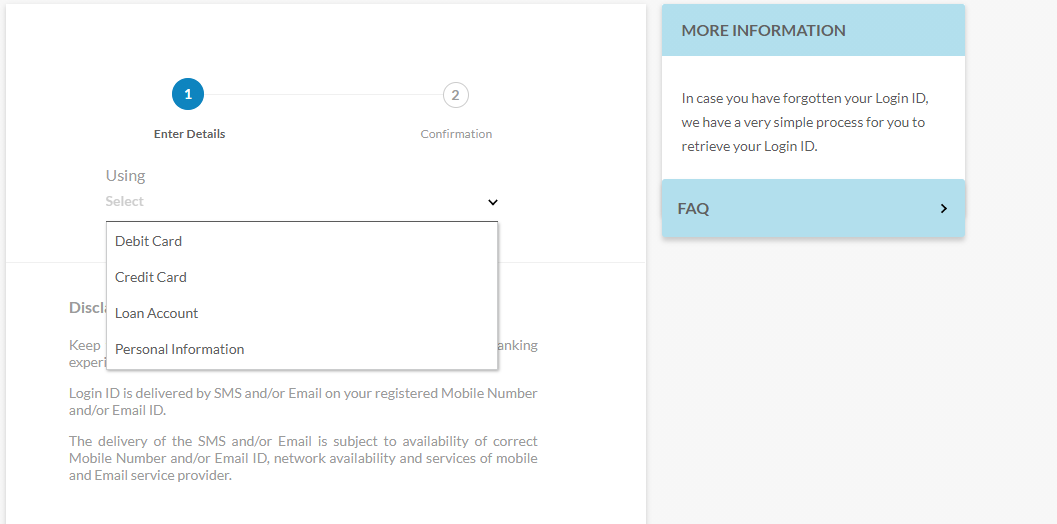

- You now have to click on the proceed button.

- You now have to select the information from the given options. For example, one can reset the login id by providing credit or debit card information.

- You can select the suitable option.

- Provide the required details, and complete the verification.

- Upon verification, one will receive the login id on their registered mobile number.

Frequently asked questions

Some questions had been repeatedly asked to us. Therefore, we have decided to cover them all in one single place. You will get the answer to every question that is generally asked related to YES bank internet banking.

Who can avail of the benefits of the YES bank internet banking program?

Anyone who has a savings or current bank account with YES Bank can avail of the internet banking facilities from the YES Bank.

Is the YES bank internet banking platform is secure?

Yes, the YES Bank internet banking platform is 100% secure. It is encrypted with 128-bit SSL encrypted connection. Additionally, the servers are secured by firewalls. However, still, it is advised to the customers that do not access the internet banking dashboard from any public WIFI.

Why I am not able to open the login page?

You are not able to visit the login page due to usual reasons. You can check the internet connectivity, though.

How to Reset the login password online?

One can quickly reset the login password online by providing credit or debit card details. Furthermore, one can also check out the process that we have added above to reset the YES Bank login password online.

Conclusion:

Yes bank is one of the leading banks of India. Yes bank was established in 2004, and it has more than 120+ branches and access to 400+ ATM’s in India. It comes under the premium leading banks of India. This bank provides all the premium banking services at a minimum average balance requirement. The requirement of MAB is Rs 10000 and if not maintained there can be extra charges added to your account. However, this requirement is nothing in front of top services from the Yes bank.

Apart from these, Yes bank is ready to serve its customers digitally with the easy net banking registration process. In this post, we have mentioned the same process for the registration and login to Yes bank internet banking. You can ask us in the comments section if there is anything left to ask about Yes bank net banking and its services.